You are here

Home 🌿 Marijuana Business News 🌿 It's that time of year when Canada's stock losers can go wild 🌿It's that time of year when Canada's stock losers can go wild

The Open Better value in Canadian stocks than American: Portfolio manager

Buying low and selling high? Maybe not in Canada right now.

As 2019 draws to a close, many stock investors have at least one reason to sell low: reduce their tax bill. While that may sound like an interesting opportunity, it could also mean wild gyrations for two of the nation’s riskiest industries.

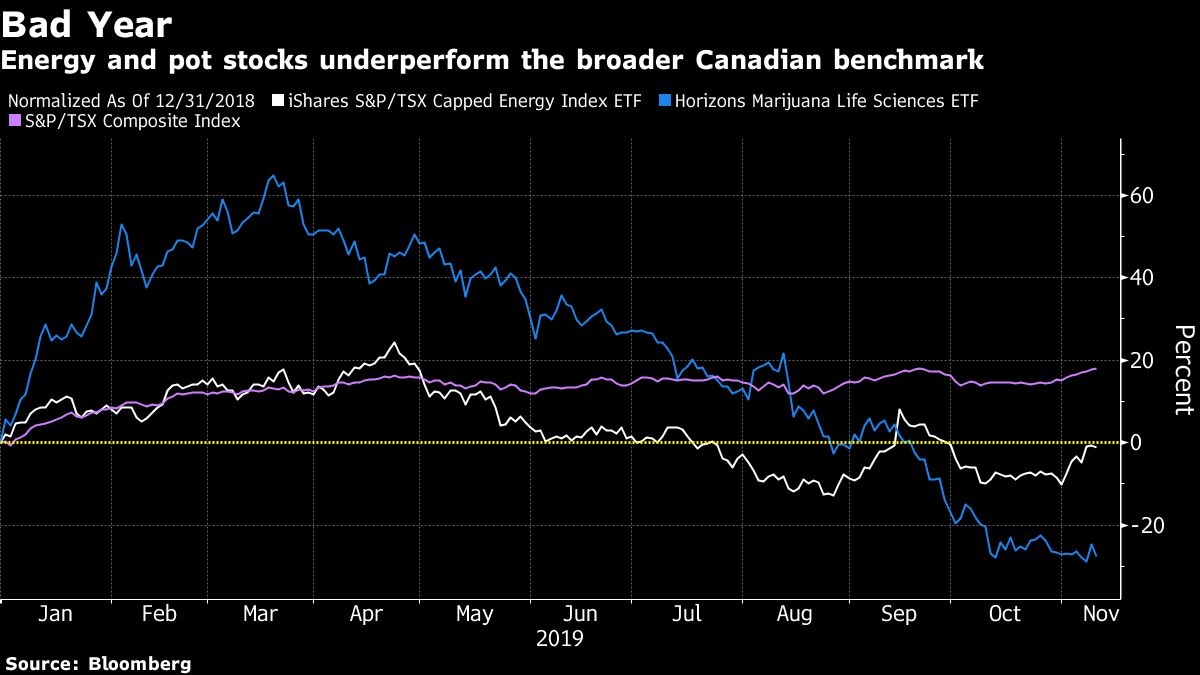

Both energy and pot shares are standing out among the biggest losers in Canada’s stock market this year. Oil and gas producers have been flailing as foreign companies pull investment from oil-sands projects amid a slump in Canadian crude versus the U.S. benchmark due to pipeline bottlenecks. Meantime, several marijuana companies have yet to turn a profit.

About 70 per cent of the energy stocks in the S&P/TSX Composite Index have hit one-year lows this year, and fewer than half of its companies have posted double-digit gains, according to data compiled by Bloomberg. The iShares S&P/TSX Capped Energy Index ETF has dropped about one per cent in 2019, compared with an 18 per cent surge in the benchmark gauge of Canadian equities.

“It seems reasonable to assume that there could be some tax-loss selling into year-end, particularly since the S&P/TSX Composite Index is up,” analysts led by Menno Hulshof at TD Securities Inc. said. Energy service providers and oil and gas mid-and-smallcaps “will be most prone to further weakness into year-end.”

Pot stocks have also been feeling the pinch as many companies continue to bleed cash and vaping lung injury concerns persist. The Horizons Marijuana Life Sciences ETF has plunged more than 50 per cent since its March peak, and most weed shares have never regained the high they hit last year.

“Such underperformance begs the question: what happens to the sector when tax-loss selling begins?” said Graeme Kreindler, analyst at Eight Capital. While investor sentiment suggests tax-selling loss could occur, sending stocks even lower, he said it’s difficult to confirm whether that has already happened or it will continue for the rest of the year.

To make things worse, analysts aren’t expecting stellar results. For MKM Partners’s Bill Kirk, this week “is going to be book-ended with cannabis disappointment” as Canopy Growth Corp. and Aurora Cannabis Inc. are slated to report on Thursday. Strategists at Canadian Imperial Bank of Commerce and Cantor Fitzgerald are also adding to the growing chorus that it’ll be a weak earnings season.

Now, there may be some light at the end of the tunnel as the tax selling could also bode well for some investors. Further weakness in energy stocks “could potentially create a buying opportunity in late December, early January,” Hulshof said.

420 Intel is Your Source for Marijuana News

420 Intel Canada is your leading news source for the Canadian cannabis industry. Get the latest updates on Canadian cannabis stocks and developments on how Canada continues to be a major player in the worldwide recreational and medical cannabis industry.

420 Intel Canada is the Canadian Industry news outlet that will keep you updated on how these Canadian developments in recreational and medical marijuana will impact the country and the world. Our commitment is to bring you the most important cannabis news stories from across Canada every day of the week.

Marijuana industry news is a constant endeavor with new developments each day. For marijuana news across the True North, 420 Intel Canada promises to bring you quality, Canadian, cannabis industry news.

You can get 420 Intel news delivered directly to your inbox by signing up for our daily marijuana news, ensuring you’re always kept up to date on the ever-changing cannabis industry. To stay even better informed about marijuana legalization news follow us on Twitter, Facebook and LinkedIn.