You are here

Home 🌿 Marijuana Business News 🌿 The Cannabis Power List: Movers and shakers we're buzzing about in the pot world 🌿The Cannabis Power List: Movers and shakers we're buzzing about in the pot world

Michael Serruya has never used cannabis. “But I am anxiously awaiting October 17,” says the managing director of Serruya Private Equity, referring to the date on which Canadians can legally consume the plant. “I think there are a lot of people like me out there.” It’s more than an idle observation: He’s deeply invested in the cannabis sector.

Michael and his brothers, Aaron and Simon, are perhaps best known to most as the trio behind Yogen Früz, founded in 1986. Today, their stable of brands also includes Yogurty’s, Pinkberry and Swensen’s ice cream. Despite their sweet tooth, their investments through Serruya Private Equity have ranged from telecom to real estate over the years, but they have also invested in around two-dozen cannabis-related firms since 2013. They’re now planning a chain of retail dispensaries and developing edibles and marijuana-infused beverages.

The Serruyas are betting their three decades in food retail will allow them to emerge as significant players in the cannabis industry. The family declined to put a dollar value on their cannabis investments, but the sector represents a large portion of their portfolio. “By our standards, it’s very significant,” Michael says.

The Serruyas got their start in the sector through a seed investment in a Leamington, Ont., flower farm that was in the process of converting to a licensed producer under the federal government’s medical marijuana program. That company, Aphria Inc., is now one of the country’s largest producers with a market cap of roughly $4 billion. They’re also the largest shareholders in Liberty Health Sciences Inc., a medicinal marijuana company based in Florida. Another holding, a California maker of edibles called Plus Products Inc., filed a preliminary prospectus in August to trade on the Canadian Securities Exchange. “We believe the U.S. is five or six years behind where Canada is today,” Michael says, adding he believes federal legalization is inevitable at this point given that so many states have already moved forward.

For now, though, much of the Serruyas’ attention remains at home. They have applied for retail licences in Alberta and plan to do the same in Ontario and British Columbia once the process is opened. They’ve already developed two different retail brands: One Plant, with the “Let’s be buds” slogan, is positioned as a higher-end label, while Purpl Flowr is designed to be a mid-market dispensary. Store renderings for both brands show bright, open concept layouts not unlike an Apple outlet, with display cases for cannabis strains, accessories and a clothing line. The stores will eventually be stocked with the Serruyas’ own line of edibles, including cookies, chocolates and gummies, which are in various stages of development. “We have an incredible ice cream,” Aaron says with a smirk. “Let’s leave it at that.”

The concept as depicted in the renderings, which show ample product branding, likely won’t comply with Canada’s strict approach to packaging, but the Serruyas believe governments will eventually loosen those restrictions. “We’re trying to stay ahead all the time to understand what the second and third innings will look like,” Michael says.

The Serruyas have identified around two-dozen properties in Ontario that could serve as retail locations. By April 2019, the date by which the provincial government has pegged for private sales, the Serruyas hope to have opened at least 10 stores followed by an aggressive rollout. The government has yet to outline private retail regulations, including how many outlets a single owner can operate. But the Serruyas are wagering Ontario will follow Alberta’s model, and the cap will be somewhere between 75 and 100 stores per operator. “We want to get to the max,” Michael says.

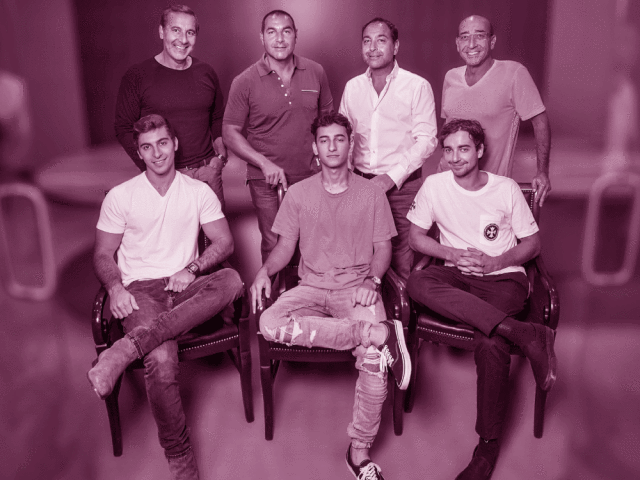

The cannabis business is a multi-generational family affair for the Serruyas. A fourth brother, Jack, is a director at Serruya Private Equity, and Michael and Aaron’s sons — Aaron, Samuel and Sammy — are driving the dispensary and edibles strategy. But Michael has made multiple trips to the U.S. states where cannabis sales are legal, spending hours hanging out in dispensaries to observe customers and staff, and glean which products are selling. (The family has also planted other observers in stores to count foot traffic.) “There are some insane, ridiculous numbers coming out of some of these dispensaries,” Michael says.

The older Aaron, meanwhile, can talk with ease about microdosing, dabbing and the high quality of California cannabis. If he gets a headache, he rubs some cannabidiol cream on his head. Even his mother, he notes, now uses CBD cream to help with a sore shoulder. “A friend of mine sent me an article recently that said there’s more money in cannabis than there is in ice cream,” he says. “It seems like a good time to transition.”

420 Intel is Your Source for Marijuana News

420 Intel Canada is your leading news source for the Canadian cannabis industry. Get the latest updates on Canadian cannabis stocks and developments on how Canada continues to be a major player in the worldwide recreational and medical cannabis industry.

420 Intel Canada is the Canadian Industry news outlet that will keep you updated on how these Canadian developments in recreational and medical marijuana will impact the country and the world. Our commitment is to bring you the most important cannabis news stories from across Canada every day of the week.

Marijuana industry news is a constant endeavor with new developments each day. For marijuana news across the True North, 420 Intel Canada promises to bring you quality, Canadian, cannabis industry news.

You can get 420 Intel news delivered directly to your inbox by signing up for our daily marijuana news, ensuring you’re always kept up to date on the ever-changing cannabis industry. To stay even better informed about marijuana legalization news follow us on Twitter, Facebook and LinkedIn.